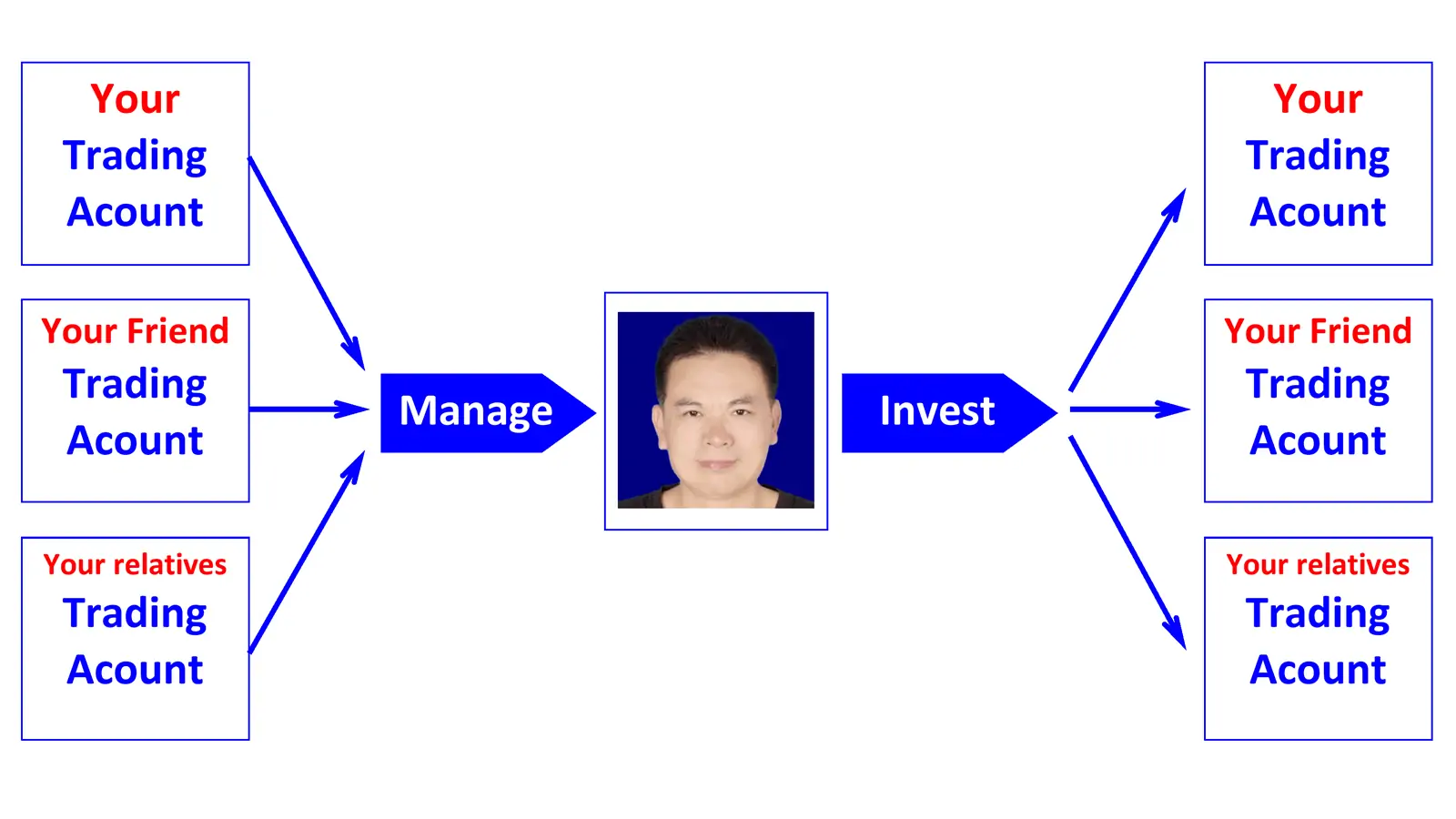

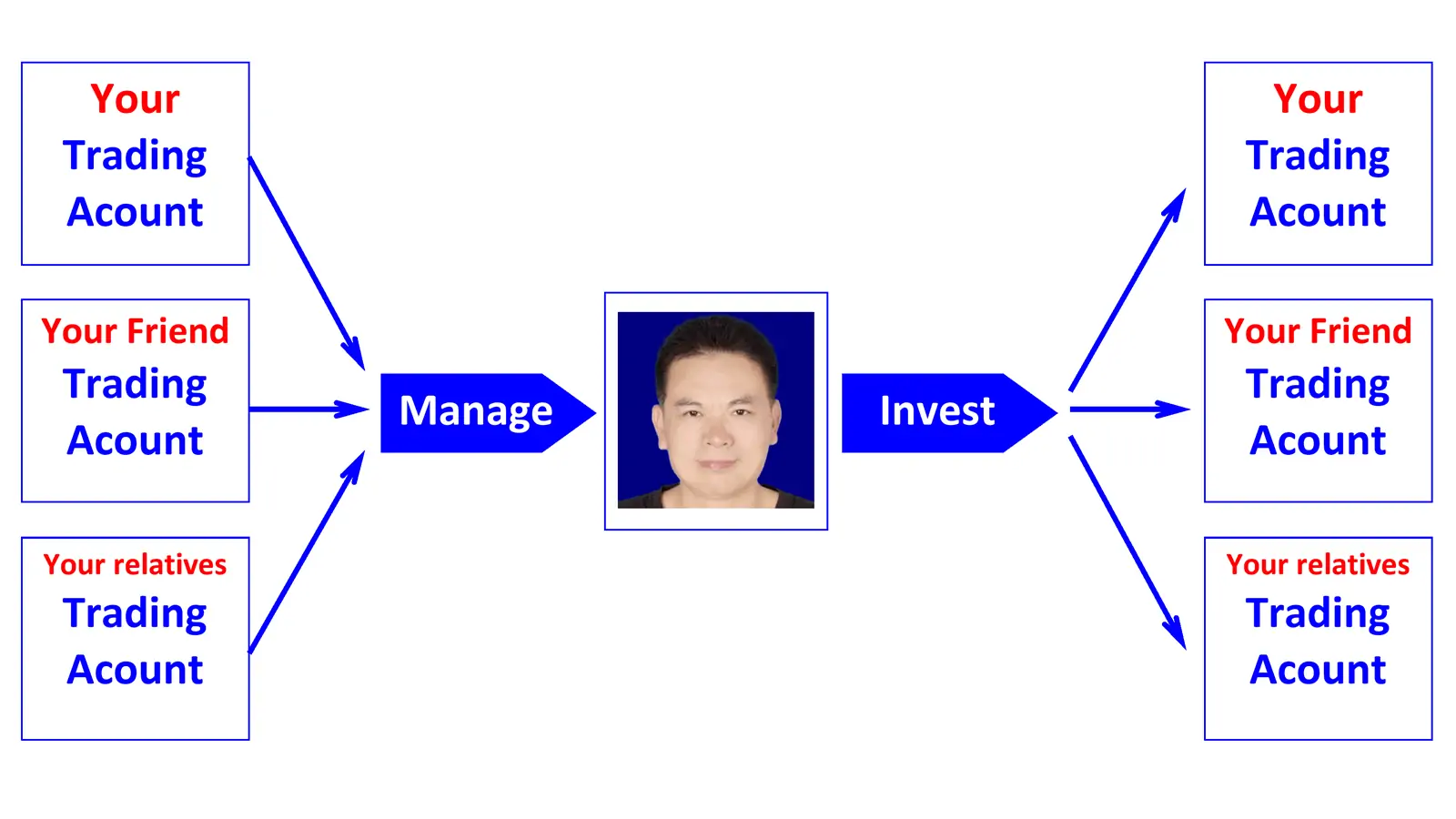

Trade for you! Trade for your account!

Invest for you! Invest for your account!

Direct | Joint | MAM | PAMM | LAMM | POA

Forex prop firm | Asset management company | Personal large funds.

Formal starting from $500,000, test starting from $50,000.

Profits are shared by half (50%), and losses are shared by a quarter (25%).

* Potential clients can access detailed position reports, which span over several years and involve tens of millions of dollars.

All the problems in forex short-term trading,

Have answers here!

All the troubles in forex long-term investment,

Have echoes here!

All the psychological doubts in forex investment,

Have empathy here!

Foreign exchange investment manager Z-X-N accepts entrusted investment and trading for global foreign exchange investment accounts.

I am Z-X-N. Since 2000, I have been running a foreign trade manufacturing factory in Guangzhou, with products sold globally. Factory website: www.gosdar.com. In 2006, due to significant losses from entrusting investment business to international banks, I embarked on a self-taught journey in investment trading. After ten years of in-depth research, I now focus on foreign exchange trading and long-term investment business in London, Switzerland, Hong Kong, and other regions.

I possess core expertise in English application and web programming. During my early years running a factory, I successfully expanded overseas business through an online marketing system. After entering the investment field, I fully utilized my programming skills to complete comprehensive testing of various indicators for the MT4 trading system. Simultaneously, I conducted in-depth research by searching the official websites of major global banks and various professional materials in the foreign exchange field. Practical experience has proven that the only technical indicators with real-world application value are moving averages and candlestick charts. Effective trading methods focus on four core patterns: breakout buying, breakout selling, pullback buying, and pullback selling.

Based on nearly twenty years of practical experience in foreign exchange investment, I have summarized three core long-term strategies: First, when there are significant interest rate differentials between currencies, I employ a carry trade strategy; second, when currency prices are at historical highs or lows, I use large positions to buy at the top or bottom; third, when facing market volatility caused by currency crises or news speculation, I follow the principle of contrarian investing and enter the market in the opposite direction, achieving significant returns through swing trading or long-term holding.

Foreign exchange investment has significant advantages, primarily because if high leverage is strictly controlled or avoided, even if there are temporary misjudgments, significant losses are usually avoided. This is because currency prices tend to revert to their intrinsic value in the long run, allowing for the gradual recovery of temporary losses, and most global currencies possess this intrinsic value-reversion attribute.

Foreign Exchange Manager | Z-X-N | Detailed Introduction.

Starting in 1993, I leveraged my English proficiency to begin my career in Guangzhou. In 2000, utilizing my core strengths in English, website building, and online marketing, I founded a manufacturing company and began cross-border export business, with products sold globally.

In 2007, based on my substantial foreign exchange holdings, I shifted my career focus to the financial investment field, officially initiating systematic learning, in-depth research, and small-scale pilot trading in foreign exchange investment. In 2008, leveraging the resource advantages of the international financial market, I conducted large-scale, high-volume foreign exchange investment and trading business through financial institutions and foreign exchange banks in the UK, Switzerland, and Hong Kong.

In 2015, based on eight years of accumulated practical experience in foreign exchange investment, I officially launched a client foreign exchange account management, investment, and trading service, with a minimum account balance of US$500,000. For cautious and conservative clients, a trial investment account service is offered to facilitate their verification of my trading capabilities. The minimum investment for this type of account is $50,000.

Service Principles: I only provide agency management, investment, and trading services for clients' trading accounts; I do not directly hold client funds. Joint trading account partnerships are preferred.

Why did foreign exchange manager Z-X-N enter the field of foreign exchange investment?

My initial foray into financial investment stemmed from an urgent need to effectively allocate and preserve the value of idle foreign exchange funds. In 2000, I founded an export manufacturing company in Guangzhou, whose main products were marketed in Europe and the United States, and the business continued to grow steadily. However, due to China's then-current annual foreign exchange settlement quota of US$50,000 for individuals and enterprises, a large amount of US dollar funds accumulated in the company's account that could not be promptly repatriated.

To revitalize these hard-earned assets, around 2006, I entrusted some funds to a well-known international bank for wealth management. Unfortunately, the investment results were far below expectations—several structured products suffered serious losses, especially product number QDII0711 (i.e., "Merrill Lynch Focus Asia Structured Investment No. 2 Wealth Management Plan"), which ultimately lost nearly 70%, becoming a key turning point for me to switch to independent investment.

In 2008, as the Chinese government further strengthened its regulation of cross-border capital flows, a large amount of export revenue became stuck in the overseas banking system, unable to be smoothly repatriated. Faced with the reality of millions of dollars being tied up in overseas accounts for an extended period, I was forced to shift from passive wealth management to active management, and began systematically engaging in long-term foreign exchange investment. My investment cycle is typically three to five years, focusing on fundamental drivers and macroeconomic trend judgments, rather than short-term high-frequency or scalping trading.

This fund pool not only includes my personal capital but also integrates the overseas assets of several partners engaged in export trade who also faced the problem of capital being tied up. Based on this, I also actively seek cooperation with external investors who have a long-term vision and matching risk appetite. It is important to note that I do not directly hold or manage client funds, but rather provide professional account management, strategy execution, and asset operation services by authorizing the operation of clients' trading accounts, committed to helping clients achieve steady wealth growth under strict risk control.

Foreign Exchange Manager Z-X-N's Diversified Investment Strategy System.

I. Currency Hedging Strategy: Focusing on substantial currency exchange transactions, with long-term stable returns as the core objective. This strategy uses currency swaps as the core operational vehicle, constructing a long-term investment portfolio to achieve continuous and stable returns.

II. Carry Trade Strategy: Targeting significant interest rate differences between different currency pairs, this strategy implements arbitrage operations to maximize returns. The core of the strategy lies in fully exploring and realizing the continuous profit potential brought by interest rate differentials by holding the underlying currency pair for the long term.

III. Long Terms Extremes-Based Positioning Strategy: Based on historical currency price fluctuation cycles, this strategy implements large-scale capital intervention to buy at the top or bottom when prices reach historical extreme ranges (highs or lows). By holding positions long-term and waiting for prices to return to a reasonable range or for a trend to unfold, excess returns can be realized.

IV. Crisis & News-Driven Contrarian Strategy: This strategy employs a contrarian investment framework to address extreme market conditions such as currency crises and excessive speculation in the foreign exchange market. It encompasses diverse operational models including contrarian trading strategies, trend following, and long-term position holding, leveraging the amplified profit window of market volatility to achieve significant differentiated returns.

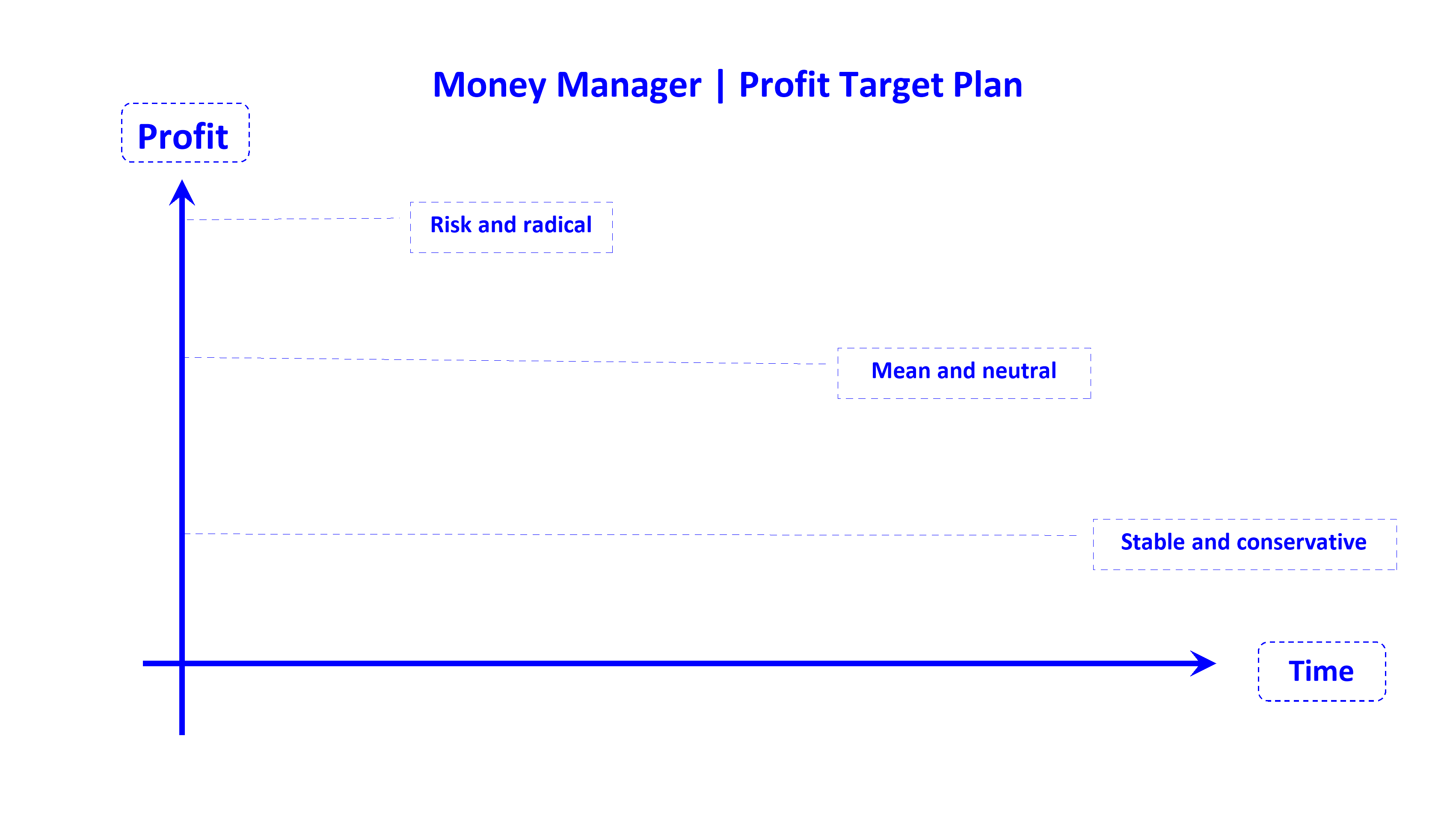

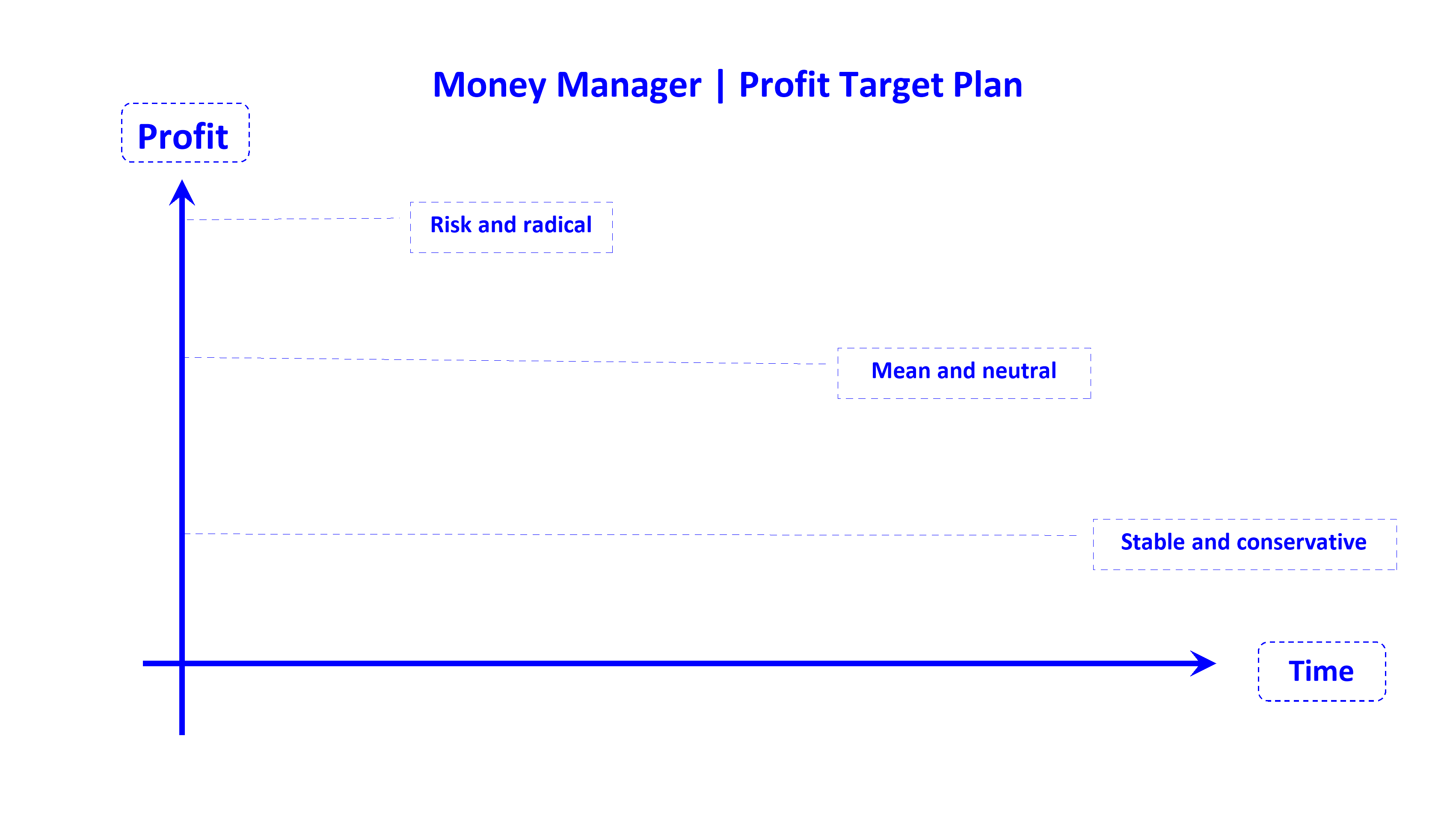

Profit and Loss Plan Explanation for Forex Manager Z-X-N

I. Profit and Loss Distribution Mechanism.

1. Profit Distribution: The forex manager is entitled to 50% of the profits. This distribution ratio is a reasonable return on the manager's professional competence and market timing ability.

2. Loss Sharing: The forex manager is responsible for 25% of the losses. This clause aims to strengthen the manager's decision-making prudence, restrain aggressive trading behavior, and reduce the risk of excessive losses.

II. Fee Collection Rules.

The forex manager only charges a performance fee and does not charge additional management fees or trading commissions. Performance Fee Calculation Rules: After deducting the current period's profit from the previous period's loss, the performance fee is calculated based on the actual profit. Example: If the first period has a 5% loss and the second period has a 25% profit, then the difference between the current period's profit and the previous period's loss (25% - 5% = 20%) will be used as the calculation base, from which the forex manager will collect the performance fee.

III. Trading Objectives and Profit Determination Method.

1. Trading Objectives: The forex manager's core trading objective is to achieve a conservative return rate, adhering to the principle of prudent trading and not pursuing short-term windfall profits.

2. Profit Determination: The final profit amount is determined comprehensively based on the market fluctuations and actual trading results for the year.

Forex Manager Z-X-N provides you with professional forex investment and trading services directly!

You directly provide your investment and trading account username and password, establishing a private direct entrustment relationship. This relationship is based on mutual trust.

Service Cooperation Model Description: After you provide your account information, I will directly conduct trading operations on your behalf. Profits will be split 50/50. If losses occur, I will bear 25% of the loss. Furthermore, you can choose or negotiate other cooperation agreement terms that conform to the principle of mutual benefit; the final decision on cooperation details rests with you.

Risk Protection Warning: Under this service model, we do not hold any of your funds; we only conduct trading operations through the account you provide, thus fundamentally avoiding the risk of fund security.

Joint Investment Trading Account Cooperation Model: You provide the funds, and I am responsible for the execution of trades, achieving professional division of labor, shared risk, and shared profits.

In this cooperation, both parties jointly open a joint trading account: you, as the investor, provide the operating capital, and I, as the trading manager, am responsible for professional investment operations. This model represents a mutually beneficial cooperative relationship established between natural persons based on full trust.

Account profit and risk arrangements are as follows: For profits, I will receive 50% as performance compensation; for losses, I will bear 25% of the losses. Specific cooperation terms can be negotiated and drafted according to your needs, and the final plan respects your decision.

During the cooperation period, all funds remain in the joint account. I only execute trading instructions and do not hold or safeguard funds, thereby completely avoiding the risk of fund security. We look forward to establishing a long-term, stable, and mutually trusting professional cooperation with you through this model.

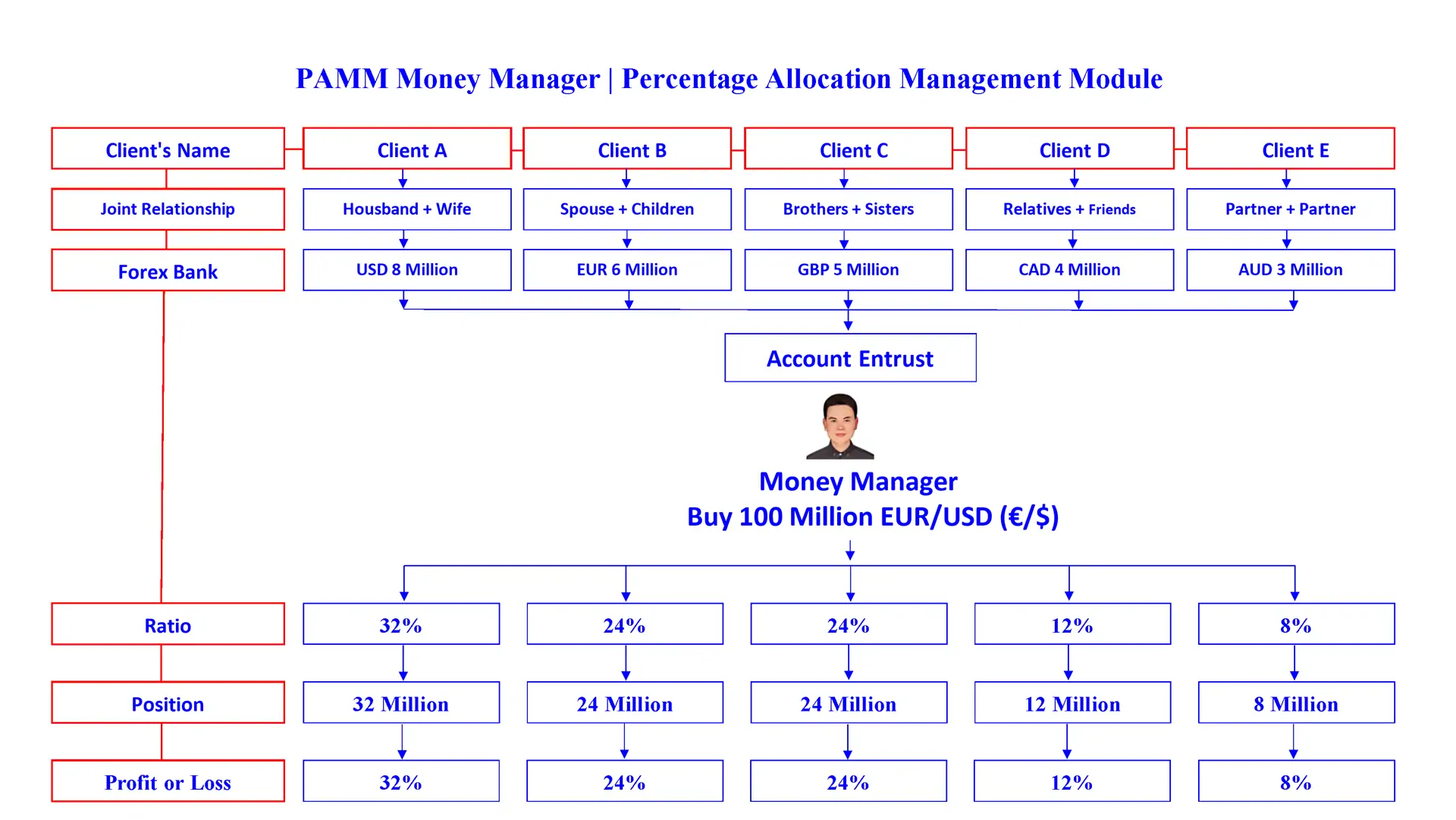

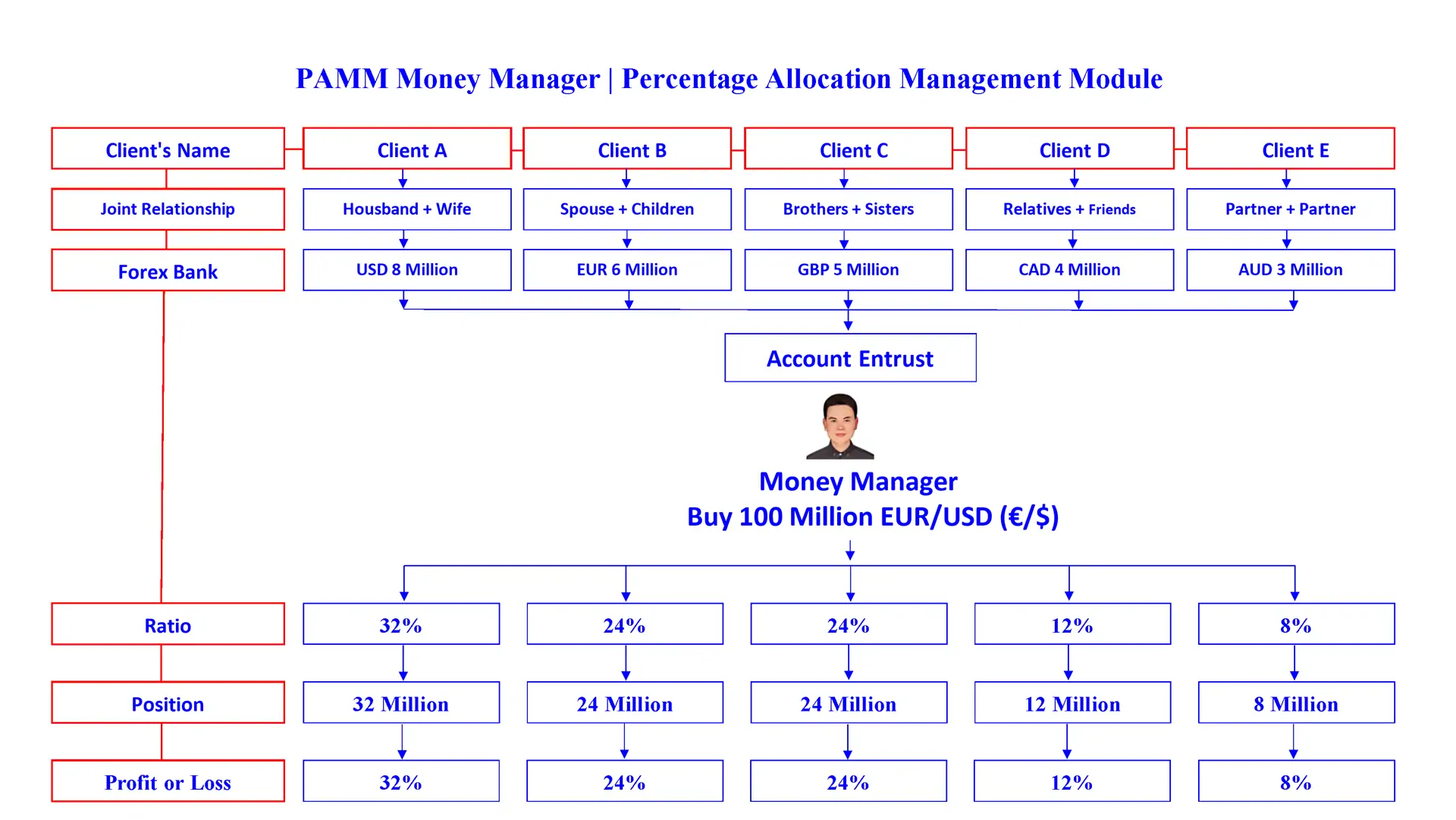

MAM, PAMM, LAMM, POA, and other account management models primarily provide professional investment and trading services for client accounts.

MAM (Multi-Account Management), PAMM (Percentage Allocation Management), LAMM (Lot Allocation Management), and POA (Power of Attorney) are all widely supported account management structures by major international forex brokers. These models allow clients to authorize professional traders to execute investment decisions on their behalf while retaining ownership of their funds. This is a mature, transparent, and regulated form of asset management.

If you entrust your account to us for investment and trading operations, the relevant cooperation terms are as follows: Profits will be split 50/50 between both parties, and this split will be included in the formal entrustment agreement issued by the forex broker. In the event of trading losses, we will bear 25% of the loss liability. This loss liability clause is beyond the scope of a standard brokerage entrustment agreement and must be clarified in a separate private cooperation agreement signed by both parties.

During this cooperation, we are only responsible for account transaction operations and will not access your account funds. This cooperation model has eliminated fund security risks from its operational mechanism.

Introduction to Account Custody Models such as MAM, PAMM, LAMM, and POA.

Clients need to entrust a forex manager to manage their trading accounts using custody models such as MAM, PAMM, LAMM, and POA. After the entrustment takes effect, the client's account will be officially included in the management system of the corresponding custody model.

Clients included in the MAM, PAMM, LAMM, and POA custody models can only log in to their account's read-only portal and have no right to execute any trading operations. The account's trading decision-making power is exercised uniformly by the entrusted forex manager.

The entrusted client has the right to terminate the account custody at any time and can withdraw their account from the MAM, PAMM, LAMM, and POA custody system managed by the forex manager. After the account withdrawal is completed, the client will regain full operational rights to their own account and can independently carry out trading-related operations.

We can undertake family fund management services through account custody models such as MAM, PAMM, LAMM, and POA.

If you intend to preserve and grow your family funds through forex investment, you must first select a trustworthy broker with compliant qualifications and open a personal trading account. After the account is opened, you can sign an agency trading agreement with us through the broker, entrusting us to conduct professional trading operations on your account; profit distribution will be automatically cleared and transferred by the trading platform system you selected.

Regarding fund security, the core logic is as follows: We only have trading operation rights for your trading account and do not directly control the account funds; at the same time, we give priority to accepting joint accounts. According to the general rules of the forex banking and brokerage industry, fund transfers are limited to the account holder and are strictly prohibited from being transferred to third parties. This rule is fundamentally different from the transfer regulations of ordinary commercial banks, ensuring fund security from a systemic perspective.

Our custody services cover all models: MAM, PAMM, LAMM, and POA. There are no restrictions on the source of custody accounts; any compliant trading platform that supports the above custody models can be seamlessly integrated for management.

Regarding the initial capital size of custody accounts, we recommend the following: Trial investment should start at no less than US$50,000; formal investment should start at no less than US$500,000.

Note: Joint accounts refer to trading accounts jointly held and owned by you and your spouse, children, relatives, etc. The core advantage of this type of account is that in the event of unforeseen circumstances, any account holder can legally and compliantly exercise their right to transfer funds, ensuring the safety and controllability of account rights.

Appendix: Over Two Decades of Practical Experience | Tens of Thousands of Original Research Articles Available for Reference.

Since shifting from foreign trade manufacturing to foreign exchange investment in 2007, I have gained a deep understanding of the operating essence of the foreign exchange market and the core logic of long-term investment through over a decade of intensive self-study, massive real-world verification, and systematic review.

Now, I am publishing tens of thousands of original research articles accumulated over more than two decades, fully presenting my decision-making logic, position management, and execution discipline under various market environments, allowing clients to objectively assess the robustness of my strategies and the consistency of long-term performance.

This knowledge base also provides a high-value learning path for beginners, helping them avoid common pitfalls, shorten trial-and-error cycles, and build rational and sustainable trading capabilities.

13711580480@139.com

13711580480@139.com

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

z.x.n@139.com

z.x.n@139.com

Mr. Z-X-N

Mr. Z-X-N

China · Guangzhou

China · Guangzhou

13711580480@139.com

13711580480@139.com

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

+86 137 1158 0480

z.x.n@139.com

z.x.n@139.com

Mr. Z-X-N

Mr. Z-X-N

China · Guangzhou

China · Guangzhou